Are you pressed for cash? Banks and other conventional lending institutions often require borrowers to have a traditional source of income to qualify for personal loans. If you don’t have a full-time job, you won’t be able to obtain any lending solution there.

What can you do instead if you urgently need additional money for the short term? No-income loans can help you receive extra funds for your needs and cover immediate money disruptions. Are you willing to get a 2500 loan no credit check today? Alternative crediting companies are eager to issue the funds to consumers and perform only a soft credit inquiry that doesn’t harm their credit. Here is what you should know about these loans before you apply.

The Pandemic Impact on Debt

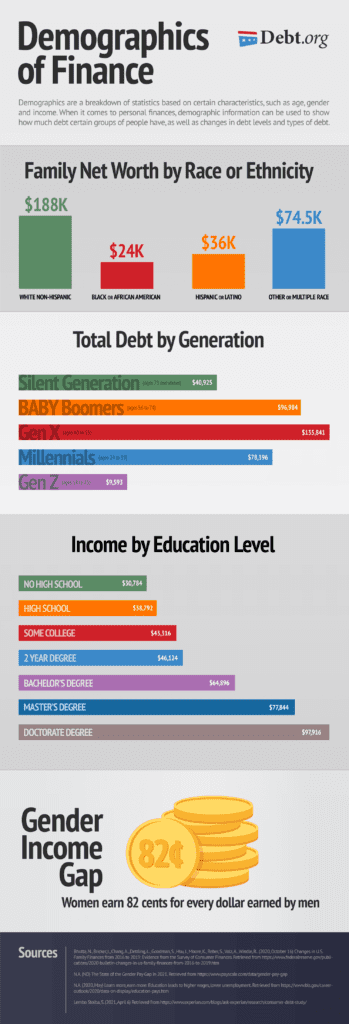

American household debt hit a record $14.6 trillion in the spring of 2021, according to the Federal Reserve. It’s important to understand demographic statistics to know who is the most likely to get into debt and to get out of it. It all depends on your age, family type, income, and educational level.

The unemployment rate increased from 3.5% before the pandemic to 14.8% in April 2020. The less a monthly income of a consumer, the easier it is to accumulate debt. Hence, thousands of people who were laid off and whose incomes were lowered had to turn to various lending solutions and accumulated debt. The data from Experian shows that the total U.S. consumer debt balance grew by $800 billion.

No doubt the wealthier you become, the more likely you are to carry debt but the easier it is to repay that debt. Consumers in the USA in the top 10% by income have a median of $222,200 in debt while Americans in the bottom 25% have less than $20,900. If you decide to purchase a home and get a mortgage, a smaller income means less chance for you to qualify for this debt.

Debt Statistics

New data from the Student Borrower Protection Center reflect that the borrowers of color and low-income borrowers are getting excluded from key protections, increasing substantial fair lending fears. Income-driven repayment (IDR) is a major shield that sets the monthly bills of the federal student loan borrowers at a reasonable amount on the basis of their salary or income, instead of determining on the basis of their total loan balance.

Statistics show that consumers who access IDR have more accomplishments in staying in harmony with their loan payments and repaying their student loans faster. Research by the Government Accountability Office discovered that the borrowers in a standard repayment system are more likely (up to 28 times) to fail to pay than those paying on the basis of their income.

IDR is a universal and widespread shield under the law, however, there are so many low-income borrowers who are missing out on taking advantage of this facility.Approximately 54 percent that is over half of borrowers under the lowest income level (with an annual income of up to $20,000) report having issues with debt repayment and having plunged behind on their student loans as a consequence of not having access to IDR.

What Are Loans With No Income?

These are the types of loans issued for consumers with income that doesn’t come from a regular full-time job. Of course, you still need to have some type of income to apply. Lenders who issue no income loans usually demand borrowers to have alternative income sources or enough liquid assets to pay the loan off. The creditor is also required to verify these income sources.

What are the examples of no-income loans? If your grandparents had set a trust for you and this is where you receive monthly payments from, it’s called an alternative source of income. Once you decide to get a mortgage and purchase a house, the creditor will check this information to verify you have enough alternative income to make regular payments. The amount of alternative income you have will define your creditworthiness and ability to repay the mortgage in the long run.

How No Income Loans Work

Personal loans for self-employed with no proof of income work similarly to other lending services. Such loans don’t demand an applicant to have a regular full-time job but he or she needs to have some alternative method or repaying the debt together with the interest. Crediting institutions you turn to will want to check your bank accounts, credit history, and proof of any liquid assets that define your ability to pay the loan off and your creditworthiness.

If you apply for loans based on income, the no credit check feature means the lender will conduct a soft credit pull to check your personal, financial, and employment data. No-income loans are more flexible as they don’t require you to have a traditional source of income. Make sure your credit history and bank accounts are in order as this is what lenders will want to verify.

A credit score is another factor lenders take into account when they check your data. They look over your distributions, assets, finance, and credit rating to define the level of risk you show to their company if they decide to issue the funds. They will most likely approve your request if your papers are in order and lenders are confident that you have enough means to repay the debt. What are the examples of cash-equivalent or liquid assets and alternative income sources? Some assets may include:

- Appraised valuables

- A house or real estate

- A vehicle

- Government bonds

Different types of alternative income consist of:

- Dividend payments or other investment income

- Social Security benefits (disability or retirement)

- Veteran Administration (VA) benefits

- A retirement account

- A job offer with an acceptance letter and an offer

- Self-employment income

- Business startup or side gigs

- Partner income

- Child support

- Unemployment benefits

- Tip income

- Royalty payments

- Alimony

In conclusion, no-income loans can serve as an alternative lending solution for consumers who don’t have a traditional source of income, such as a full-time job. Make sure you understand the rules and obligations of the loan before you sign the agreement and always look at several offers to compare the terms and interest rates.