If you are dealing with a high risk business currently, you must know the difficulties that come with all business transactions. To avoid these difficulties you need to open a high risk merchant account. A high risk merchant account enables you to understand all associated risks of a high risk organization and helps you to avoid issues with bad credit. High Risk Merchant highriskpay.com is considered a merchant or dealer account manager that helps high risk organizations to effectively deal with financial difficulties. If you are a newbie in this industry and looking for some valuable information about High Risk Merchant, this is just the right place for you. Here you can learn about all the basics and essentials of High-Risk Merchant highriskpay.com.

What is High Risk Merchant highriskpay.com

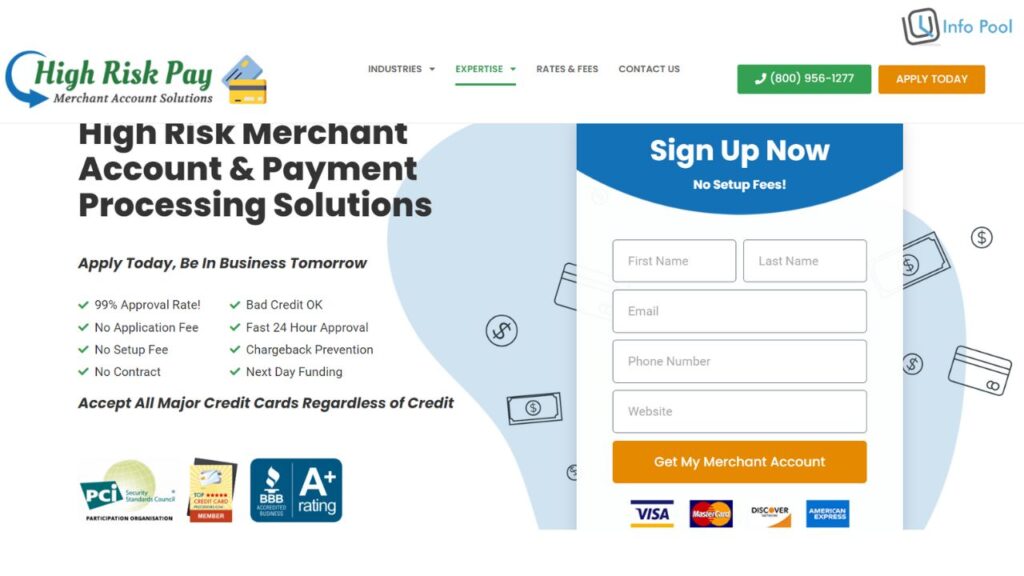

Established in 1997, High Risk Merchant highriskpay.com is a leading high risk merchant account provider that has a specialisation in providing payment processing solutions for high risk businesses. Since the time of its establishment, this service provider has experienced considerable uplift in the credit card division. They mainly provide customised solutions to meet the unique needs of the high risk businesses such as securing payment gateways, preventing fraud, ensuring chargeback protection and many others. Their mission is to not just be dependable but also provide customer satisfaction. Being true to their mission High Risk Merchant highriskpay.com effortlessly links merchant accounts with various trusted processing solutions through banks using their wide network. They provide their services at a reasonable price which has made this service provider more trustworthy and well-loved. They successfully enable their clients to keep their business thriving even in a critical situation. The best part is that they offer 27*7 live customer service and quick account approval time. Now, take a look at all the basic information you need to know about this High Risk Merchant.

High Risk Merchant highriskpay.com basics: A quick overview

| Service Provider Name | High Risk pay |

| Industry/Sector | Accounting and Financial Services |

| Company Type | Private |

| Headquarters | Greater Los Angeles, Western US |

| Foundation Date | April 2nd, 1997 |

| Website | highriskpay.com |

| Contact No | (800) 956-1277 |

| Email ID | sales@highriskpay.com |

| Address | 27702 Crown Valley Pkwy Suite D4-120, Ladera Ranch California 92694, USA |

| Current Operating Status | Active |

What does a High-Risk Merchant Account mean?

Before diving deeper into this it will be helpful to develop a basic idea about high-risk merchants and high-risk merchant accounts. High-risk merchants are businesses that operate in industries that have high-risk transactional profiles. In short, these are businesses that have higher than average transactional rates. This basically means that financial service providers like High-Risk Merchant highriskpay.com view these businesses as more prone to fraud. A high-risk pay merchant account helps these types of businesses to lessen chargeback costs, fraudulent charges and other similar expenses. High-risk merchants face significant difficulties when dealing online as they do not have an operational physical store. Due to this reason, banks and transactional institutions find it difficult to trust them. Opening an account with High-Risk Merchant highriskpay.com enables these businesses to get extra help in developing better security and protection against scammers and fraud customers. This little extra help makes these businesses flourish in their respective industries and opens up opportunities for their future growth.

The reasons you need an account from High-Risk Merchant highriskpay.com

If you are still wondering why you required a High-Risk Merchant highriskpay.com account, I will make it clearer for you. You definitely need a high-risk merchant account if your business has at least one of the following things- 1) bad credit, 2) a history of fraud, 3) high chargebacks, and 4) a risk of customer fraud. Now if your business has faced all these aforementioned issues, you should immediately open an account with High-Risk Merchant highriskpay.com to ensure its future security. For vulnerable businesses like subscription businesses or adult industries, high risk merchant accounts are a necessity as these accounts safeguard them against consumer fraud.

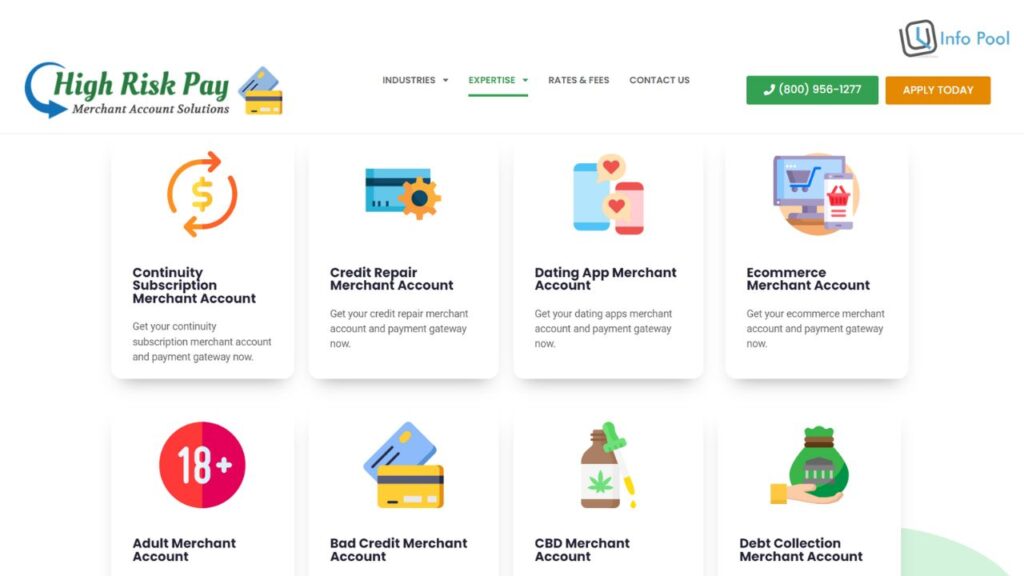

Industries that can avail benefits

I’m sure you want to know more about the industries that need to use high risk pay merchant accounts to protect their business. Well, to help you understand better I will make a list of these industries so that you can cross-check if your business falls under these.

- Online dating and adult entertainment industries

- Online gaming and gambling

- Travel agencies and timeshare industries

- Cryptocurrency exchanges

- E-cigarette and vape shops

- CBD product industry

- Online firearm sales

- Debt collection agencies

- IT services and tech support industries

- Loan and advance cash services

Areas of Expertise

Before you open an account with High-Risk Merchant highriskpay.com, you should know their field of expertise. These are the unique features of this service provider and the reasons behind their wide popularity.

Instant Approval

One of the best features of highriskpay.com is that it provides the applicant with instant approval. Their approval process usually takes 24-48 hours. Additionally, their approval rate is 99% which ensures you a guaranteed approval.

ACH Processing

Another crucial feature of highriskpay.com is Automated Clearing House or ACH processing. This feature ensures smooth and effortless processing of electronic checks. This is really crucial for businesses in the high risk industry.

Chargeback Prevention

An account with High-Risk Merchant highriskpay.com enables your high risk business to reduce the chargebacks by nearly 86%. They send an immediate alert to the merchants whenever the cardholders file a dispute. This helps in recovering the lost sales and reducing fraud.

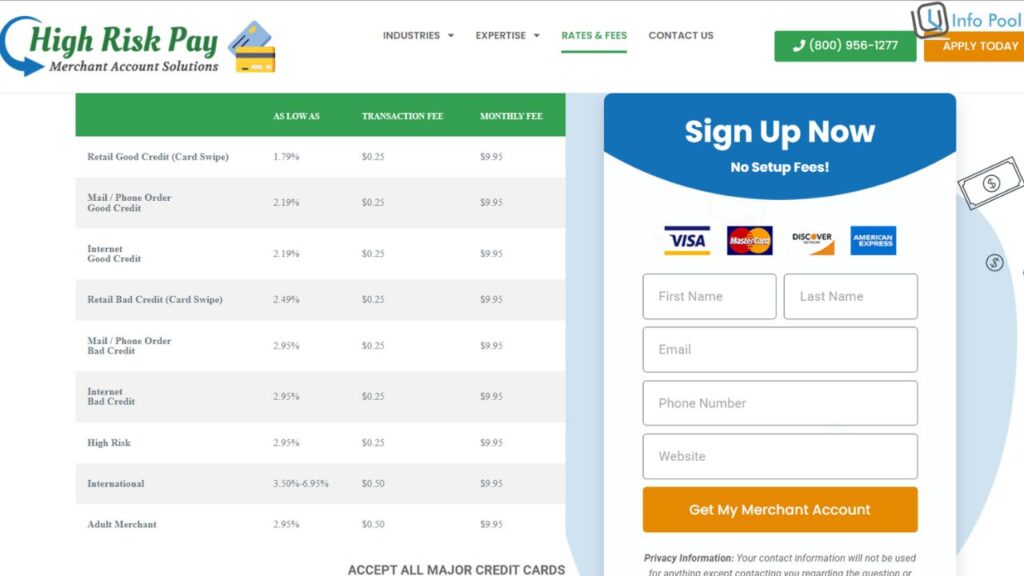

The pricing structure of High-Risk Merchant highriskpay.com

Now that you know almost every necessary detail about High-Risk Merchant highriskpay.com, you must be wondering about its pricing. To satisfy your curiosity I will give an overview of its pricing structure.

| Types | Monthly Fee | Transaction Fee | Lowest Rate |

| High Risk | $9.95 | $0.25 | 2.95% |

| Adult Merchant | $9.95 | $0.50 | 2.95% |

| International | $9.95 | $0.50 | 3.50%-6.95% |

| Internet Good Credit | $9.95 | $0.25 | 2.19% |

| Internet Bad Credit | $9.95 | $0.25 | 2.95% |

| Retail Good Credit | $9.95 | $0.25 | 1.79% |

| Retail Bad Credit | $9.95 | $0.25 | 2.49% |

| Phone/Mail Order Good Credit | $9.95 | $0.25 | 2.19% |

| Phone/Mail Order Bad Credit | $9.95 | $0.25 | 2.95% |

Advantages of this merchant account

You can have several benefits if you open your business merchant account with High-Risk Merchant highriskpay.com. Let’s have a look at those benefits.

High-level security: The highriskpay.com merchant account provides a higher level of security not only to the business but also to the customers. It protects your business from fraud.

Debit and credit card acceptance: highriskpay.com allows your transaction through both debit cards and credit cards so that you can effortlessly deal with international brands.

Chargeback Protection: An active account with High-Risk Merchant highriskpay.com helps you to protect your business from chargebacks. This significantly increases your business value.

And that’s a wrap!

Well, now you know everything you need to know about a high risk pay merchant account. I really hope this article has cleared out your confusion a little bit. If you are dealing with a high risk business, I will strongly recommend you to give highriskpay.com a try. Good Luck!