Embarking on the journey to establish a solid credit foundation is crucial for unlocking the doors to significant financial milestones, such as obtaining a mortgage, financing a vehicle, or securing the best credit cards with favorable terms. For those starting with a blank slate in terms of credit history, the path might seem daunting.

However, with strategic steps and the right tools at your disposal, building a robust credit profile from the ground up is entirely achievable. This post outlines six essential strategies to lay down a strong credit foundation, ensuring you’re well-equipped to qualify for the best credit cards and loans in the future.

Step 1: Grasp the Basics of Credit Scoring

First and foremost, understanding what constitutes a credit score is crucial. A credit score is a numerical representation of your creditworthiness, influenced by several factors: payment history, credit utilization, length of credit history, new credit, and credit mix.

The FICO score, the most widely used model, ranges from 300 to 850, with higher scores indicating better creditworthiness. Familiarizing yourself with these components allows you to target your efforts effectively.

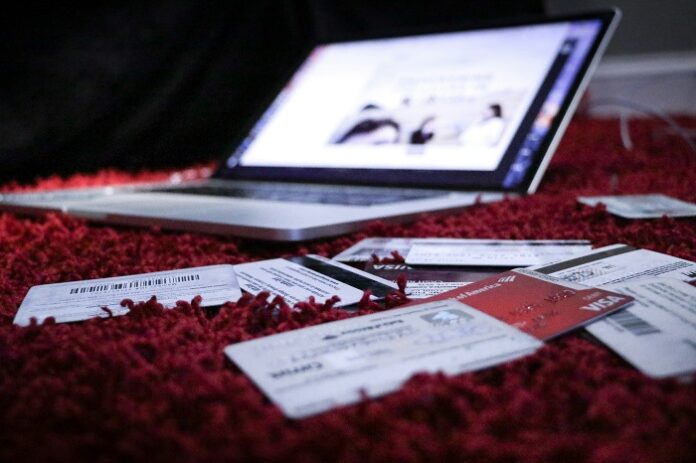

Step 2: Start with a Secured Credit Card

For those with no credit history, a secured credit card is an excellent first step. This type of card requires a cash deposit, which typically serves as your credit limit. It’s designed to minimize risk for the lender, making it easier for individuals without credit to qualify. To use a secured card to build credit, focus on making small purchases you can pay off each month in full, demonstrating your reliability as a borrower.

Step 3: Become an Authorized User on an Existing Account

Becoming an authorized user of a trusted person’s credit card account is another effective strategy. This allows you to benefit from the primary cardholder’s credit history without the obligation to make payments. It’s vital to choose someone who manages their credit responsibly, as their habits will impact your credit history.

Before taking this step, confirm that the card issuer reports authorized user activity to the credit bureaus.

Step 4: Utilize Rent and Utility Payments

Regular expenses, such as rent and utilities, can also help build your credit. Services like Experian Boost allow you to add these payments to your credit history. Not all scoring models include these payments, but for those that do, they can provide a significant boost to your credit score. This method leverages your existing payment habits to improve your creditworthiness.

Step 5: Consider a Credit-Builder Loan

Credit-builder loans are unique financial products aimed at individuals looking to establish or improve their credit. With this type of loan, you don’t get all the money right away. Instead, the lender places the money in a secured account while you make payments towards the loan.

These payments are reported to the credit bureaus, contributing positively to your credit history. After the loan term, you gain access to the funds, having built up your credit in the process.

Step 6: Adopt and Maintain Good Financial Habits

The foundation of a good credit score is built on consistent, positive financial behavior:

- Make Payments on Time: Timeliness in paying bills is critical. Make some payments automatic or set up reminders on your calendar to make payments on time.

- Maintain Low Credit Utilization: Keeping your credit utilization ratio—how much credit you’re using compared to how much you have available—below 30% is ideal. This demonstrates that you’re not overly dependent on credit.

- Regularly Monitor Your Credit: Keep an eye on your credit report for errors or fraudulent activity. You can request a free credit report annually from each of the three major credit bureaus via AnnualCreditReport.com.

Bonus: Engage with Community Banks or Credit Unions

An often overlooked but effective method for building credit involves engaging with community banks or credit unions:

- Personalized Service: Community banks and credit unions typically offer a high level of customer service, which can be invaluable for those new to credit. They’re often more willing to discuss your financial situation and offer products that match your needs.

- Credit Builder Products: Many of these institutions offer specific products aimed at building or rebuilding credit. These might include secured loans that use your savings as collateral or low-limit credit cards with manageable fees.

- Financial Education: Alongside credit products, local banks and credit unions often provide educational resources to help customers understand credit and manage their finances effectively. This education can be a cornerstone of responsible credit use.

Embarking on the path to building credit with no history is a strategic journey that requires careful planning and disciplined financial behavior. Remember, the goal of building credit is not just to achieve a high score but to open up opportunities for future financial goals.